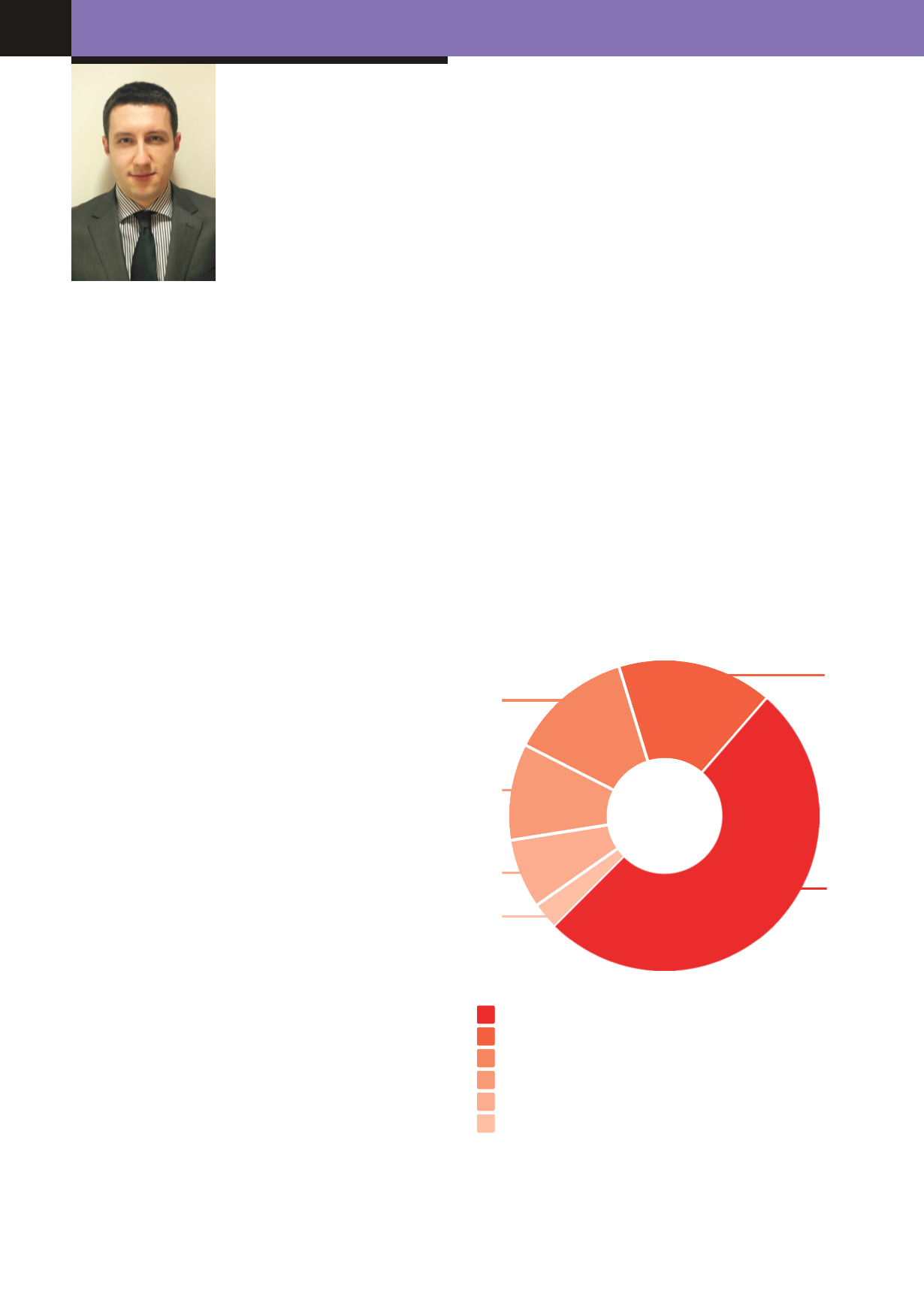

When looking at the characteristics of the insurance frauds

identified for this moment, it intensively observed that Accident

Investigation Report fraud is higher.

Self-destruction fraud

False documents fraud

Underwriting after damage

Other

Planned damage

Fake accident report fraud

3

7

10

13

16

51

%

When looking at what is done in the fight against insurance

fraud in European Countries, we see that it is carried out

combat with different legal and institutional sub-structures.

In Spain, it is considered as a criminal activity under the

Criminal Code of 1995. On an administrative level "supervi-

sory authority" has the right to make arrangements on insur-

ance fraud, to report insurance fraud to the specialized

institutions and to cooperate with domestic and foreign

authorities related to the subject.

Insurance frauds and combat with these has been always

one of the most important agendas of the insurance industry

in the world and in our country also. Insurance frauds

which increasingly diversified over time are considered to

be the most common economic crime after tax evasion in

developed countries. However, subject of fraud the nature of

the actions constantly changing shape according to the mea-

sures taken and that directs us to work towards the establish-

ment of a self-renewing systematically combat system.

Briefly, insurance fraud is described hiding an important

truth which will change the insurance company's decision

or deceiving of the insurer by the insured knowingly and

intentionally by means of a statement unrealistic.

In the literature it is encountered in two different processes

with the cases of Insurance fraud.

1. At the stage of underwriting of the Policy

To give false information to the insurance company or

intentionally hide a critical issue in order to ensure that the

insurance company make the agreement which it will not

do under normal circumstances.

2. At stage of damage

To cause a damage intentionally or overestimate the

amount of the damage occurred. According to the data of

the European Insurance and Reinsurance Federation

(CEA), the insurance companies can detect only 5% -

10% part of the fraud.

''Coalition Against Insurance Fraud'' which is established in

the United States to combat frauds of insurance declared

that annual cost of the insurance frauds to the sector is

U.S. $ 80 billion. According to the data of Insurance Fraud

Bureau which was established to fight against insurance

frauds, the annual cost of fraud to the insurance sector is 1.9

billion GBP and this leads to 44 GBP additional costs per

1

2

Insurance Fraud

Business Analysis

Specialist

Ozan

ÖZDEMİR

ARTICLE

12